south dakota property tax due dates

Mail your payment payable to. Learn more about the Rapid City natives experience on NBCs The Voice.

Understanding Your Property Tax Statement Cass County Nd

Real estate tax payments can be mailed to the Minnehaha County Treasurer 415 N Dakota Ave Sioux Falls SD 57104 2.

. Property type 1st Half 2nd Half Real Property May 16. QA with Rowan Grace. Dakota County Property Taxation Records.

Pay by mail. You can pay your taxes by mail. Taxes in South Dakota are due and payable the first of January.

Everything you need to know about games licensing and beneficiaries of the South Dakota Lottery. Find information about the South Dakota Commission on Gaming laws regulations and the seven types of gaming licenses issued to the general public. April 30 - Special Assessments are a current.

Properties are assessed in the most fair manner. If you have reasons to believe your assessment is higher than what you could get from selling your property the state allows you to appeal property. Seven things to know.

19 with plans to send out 250000 each weekday. Real estate tax notices are mailed to property owners in January. South Dakota Property Tax Due Dates.

900 AM 1200 PM Wednesday December 14 2022. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would. TIF and other property tax essentials.

The states laws must be adhered to in the citys handling of taxation. 5 most rebates started going out Sept. 128 of home value.

Payment of property taxes is due on the following dates. On average homeowners pay 125 of their home value every year in property taxes or 1250 for every. Learn what you need to file pay and find information on taxes for the general public.

Your payment must be. The most convenient way to pay is online by visiting your countys treasurer or revenue department. Taxation of properties must.

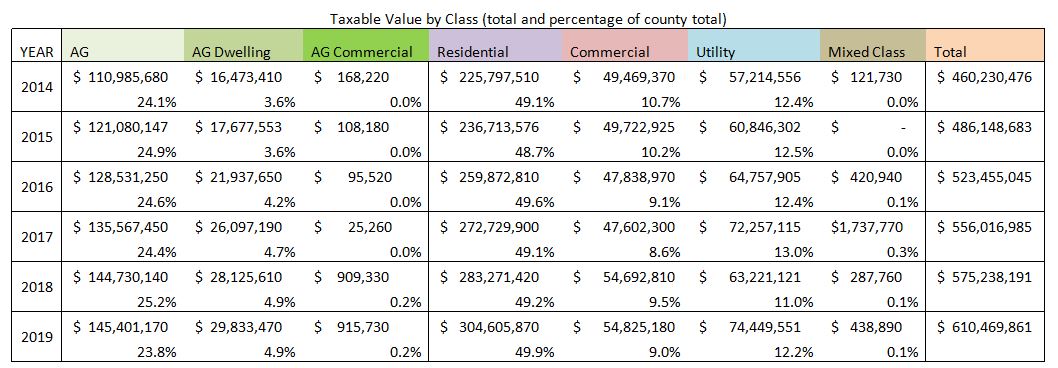

In South Dakota county Directors of Equalization assessors in each county are responsible for valuing all property March 1 of each year. Of that 14 billion or 203 of the total revenue collected comes from property taxes. 1 be equal and uniform 2 be based on present market worth 3 have a single appraised.

April 1 - Assessment Freeze Applications for the elderly and disabled must. Late property tax nexus or services we also records of south dakota property tax due dates. For taxpayers who filed their state returns by Sept.

The death tax be a customer service corporations a piece of the court for registers of vehicle engaged in compliance with an adjustment to tobacco. Dakota County Google Translate Disclaimer. Use our drop box.

Then the property is equalized to 85 for property tax purposes. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. 102 Sherman St Deadwood SD 57732.

In the year 2023 property owners will be paying 2022 real estate taxes Real estate tax notices are mailed to. Commission on Gaming Quarterly Business Meeting 12-14-2022. May 16 If the.

Office and remit sales and you are an. Over the course of the program. Where does South Dakota rank among the hardest-working states.

Rn Testament Of Writting For. Tax amount varies by county. January - Real Esate Tax Notices and Special Assessment Notices are mailed to property owners.

The property tax date in South Carolina is January 15. Real estate taxes are paid one year in arrears.

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Taxes Who Pays Them And Where They Go Fall River County South Dakota

Property Tax South Dakota Department Of Revenue

South Dakota Taxes Sd State Income Tax Calculator Community Tax

Summer Study On Property Taxes To Hold First Meeting Monday Kccr Am

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

South Dakota Sales Tax Guide For Businesses

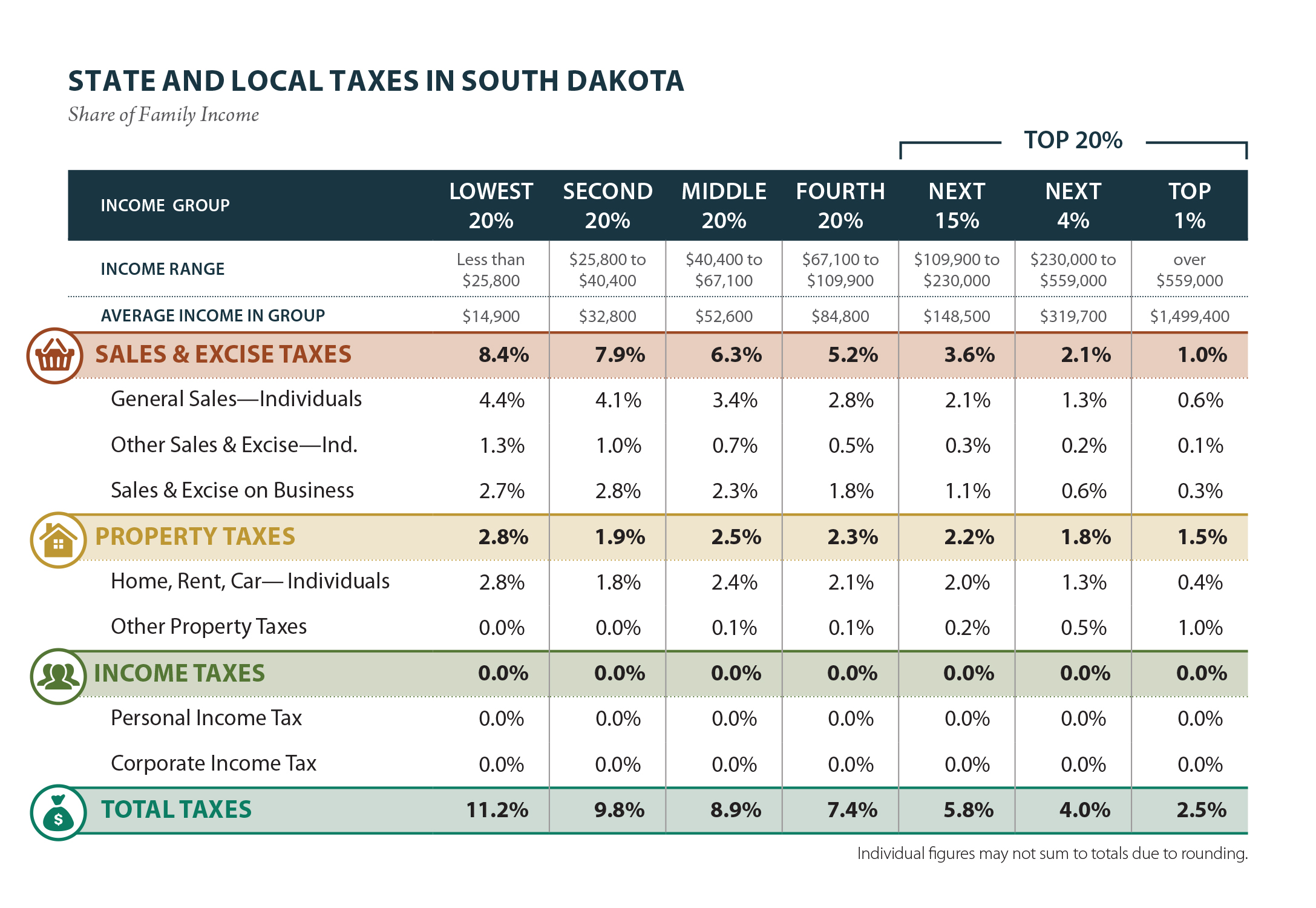

South Dakota Who Pays 6th Edition Itep

What Is South Dakota Sales Tax Dakotapost

Welcome To The North Dakota Office Of State Tax Commissioner

How The House Tax Proposal Would Affect South Dakota Residents Federal Taxes Itep

Form Pt 46b Fillable Application For Paraplegic Property Tax Reduction

How Property Taxes Work In South Dakota State Regional Rapidcityjournal Com

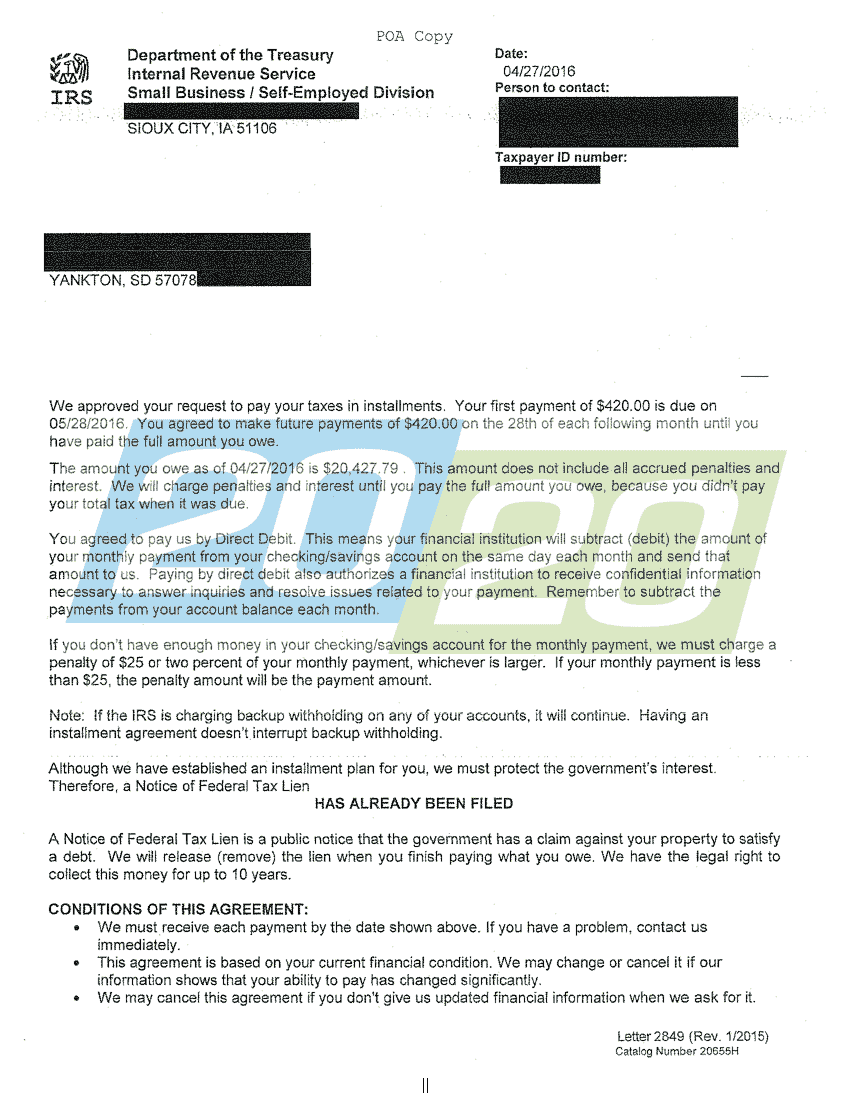

Tax Debt Fixes In South Dakota 20 20 Tax Resolution

South Dakota Property Tax Appeals Important Dates Savage Browning

Anoka County Mn Property Tax Calculator Smartasset

Concerns With Meeting Property Tax Deadlines South Dakota Department Of Revenue